Here is a concise summary of the news article: Connectd, a London and New York-based company, has raised $7 million in funding to support its platform that matches startups with "fractional" workers, senior expert professionals who advise multiple organizations simultaneously. The company has seen significant growth, surpassing $11 million in annual recurring revenue and facilitating over 25,000 connections between fractional executives and startups since 2019. Connectd's AI technology analyzes a startup's financial systems to identify areas where they need help and provides access to elite perspectives and guidance without the cost and long-term commitment of a senior hire. The funding will help Connectd expand its proprietary AI technology and continue its expansion into the US market.

Read full articleJuly 22, 2025 • By cji@businessinsider.com (Christine Ji)

Some mainstream economists, including Mohamed El-Erian and Jeremy Siegel, are calling for Federal Reserve Chair Jerome Powell to resign. They argue that his resignation could save the Fed's independence, which is being eroded by controversies surrounding Powell. El-Erian believes that Powell's resignation would be better than the current situation, where the Fed's reputation is being damaged. Siegel is concerned that if the economy deteriorates, President Trump could use Powell as a scapegoat and potentially gain more power over the Fed. However, Treasury Secretary Scott Bessent has expressed a more measured view, stating that he doesn't think Powell should resign at this time.

July 22, 2025 • By Raymond Tribdino

Here is a concise summary of the news article: Francisco Motors Corp. (FMC), a Philippine automotive company, is set to export its electric vehicle, the Pinoy Transporter, to Nigeria. Chairman Elmer Francisco expressed frustration over the slow processing and lack of support from Philippine businesses and government agencies in developing the e-vehicle market. Despite this, FMC has partnered with Nigerian entrepreneur Emmanuel Akpakwu to introduce the Pinoy Transporter to Nigeria and eventually to other West African countries. The company plans to establish a manufacturing plant in Nigeria and transition from importing completely built-up units to local assembly. FMC also aims to develop a hydrogen economy and has partnered with international companies to produce hydrogen-powered engines. The project aims to provide efficient and sustainable transportation to Nigeria and other African countries, with an initial delivery of 100 units and a goal of scaling up to 2,000 units in Lagos alone.

July 22, 2025 • By SETH BORENSTEIN AP science writer

The United Nations has reported a global shift towards renewable energy, calling it a "positive tipping point" where solar and wind power will become even cheaper and more widespread. In 2024, 74% of the growth in electricity generated worldwide came from wind, solar, and other green sources, with 92.5% of new electricity capacity added to the grid coming from renewables. The cost of solar power is now 41% cheaper and wind power is 53% cheaper than the lowest-cost fossil fuel. Despite this progress, the switch to renewable energy is not happening fast enough, with Africa representing less than 2% of new green energy capacity installed last year. The UN is calling for increased investment in renewable energy, particularly in developing countries, and for major tech firms to power data centers with renewables by 2030.

July 22, 2025

US Treasury Secretary Scott Bessent stated that he doesn't see a reason for Federal Reserve Chairman Jerome Powell to resign immediately. Bessent's comments come amid growing pressure from the Trump administration to cut interest rates. Powell's term ends in May 2026, and Bessent believes he should see it out if he wants to, but can leave early if desired. This follows Bessent's call for an internal review of the Fed's non-monetary policy operations, citing "significant mission creep". The Fed has kept interest rates steady, drawing criticism from President Trump, and will hold its next policy meeting at the end of the month.

July 22, 2025 • By Ahmed Adel

The Republican administration under US President Donald Trump, like the previous Democratic administration, considers the most important strategic task to be preventing the rise of China. However, th…

July 22, 2025 • By TelecomTV Staff

Here is a concise summary of the news article: T-Mobile US is deploying Low Latency, Low Loss, Scalable Throughput (L4S) capabilities to support low-latency services, leveraging its 5G standalone capabilities. This move is expected to give T-Mobile US an edge over its competitors, AT&T and Verizon. In other news, Dell'Oro Group forecasts that the optical transport networking technology sector will grow at an average rate of 5% for the next five years, driven by increasing investments in datacentre interconnect (DCI) infrastructure. Perplexity, a generative AI-enabled conversational search engine developer, has partnered with Telecom Italia and Telefónica Tech to offer its services to customers. Additionally, Optiva, a BSS vendor, is in talks to be acquired, and Sinch, a CPaaS specialist, has reported a 2% year-on-year increase in organic revenues. Researchers at QuEra Computing have demonstrated the reality of "magic state distillation" in logical qubits, a process that could enable fault-tolerant quantum computing. The UK government has signed a Memorandum of Understanding (MoU) with OpenAI to use its artificial intelligence technology in the UK's public services sectors, despite concerns about job losses and data privacy. These developments highlight the ongoing advancements in 5G, AI, and quantum computing, and their potential impact on various industries and societies.

July 22, 2025 • By Trefis Team, Contributor, Trefis Team, Contributor https://www.forbes.com/sites/greatspeculations/people/trefis/

Invesco's stock surged 15% after the company filed a proxy statement to restructure the Invesco QQQ Trust, a popular ETF with over $355 billion in assets. The proposed change would transition the fund from a unit investment trust to an open-ended fund, potentially generating an additional $140 million in revenue for Invesco. However, despite this positive development, the stock's current valuation and operational performance raise concerns. Invesco's financial health and growth prospects are weak, and the stock has underperformed the S&P 500 index during recent downturns. While the potential for profit growth exists, the stock remains a challenging buy due to its slow growth and poor downturn resilience. Investors may want to consider alternative options, such as the Trefis High Quality portfolio or the Reinforced Value Portfolio, which have outperformed the market and offer stronger returns with lower volatility.

July 22, 2025 • By Ashley Lutz, Nick Lichtenberg

Here is a concise summary of the news article: The rise of automated bots on the internet is distorting online metrics, potentially inflating the internet economy and contributing to a tech and AI investment bubble. According to Imperva, bots now make up over 50% of global internet traffic, with 20% being "bad bots" that engage in malicious activities such as generating fake pageviews and clicks. This can lead to inflated user numbers and engagement stats, which can misrepresent a company's underlying business strength. The issue is exacerbated by the fact that many startups showcase "vanity metrics" that can be easily manipulated by bot traffic. Regulators, such as the Federal Trade Commission, are starting to address the problem with new rules and guidelines aimed at promoting transparency and accuracy in online marketplaces. As awareness of the issue grows, investors and analysts may become more skeptical of headline user numbers and engagement stats, potentially leading to a correction in the market.

July 22, 2025 • By Ashley Lutz, Nick Lichtenberg

The AI boom has surpassed the 1990s dotcom bubble, with a significant portion of online interactions being driven by bots rather than real users. Bots have been present on the internet since the 1960s, with early examples including ELIZA and Microsoft's Clippy. However, the rise of social media has led to an increase in malicious bots spreading misinformation and manipulating public opinion. As a result, governments are focusing on regulating bots, with some states introducing laws requiring bots to identify themselves when interacting with voters or consumers. The use of fake or inflated data, often driven by bot traffic, can misrepresent a company's value and strength.

July 22, 2025 • By Benji Stawski and Danyal Ahmed

The Citi AAdvantage Platinum Select World Elite Mastercard offers several benefits for American Airlines flyers. New cardholders can earn 80,000 bonus miles after spending $3,500 in the first four months, worth $1,240 according to TPG's valuations. The card also waives the first checked bag fee on domestic American Airlines flights, offers Preferred Boarding, and provides a $125 flight credit after $20,000 in purchases. Additionally, cardholders receive 25% savings on inflight food and beverages, 2 miles per dollar spent on American Airlines purchases, and 2 miles per dollar spent at restaurants and gas stations. The card has a $99 annual fee, which is waived for the first year, and no foreign transaction fees. It's a great option for occasional AA flyers and those looking to score premium-cabin redemptions on American partners.

July 22, 2025 • By Daily Hodl Staff

Best-selling author Robert Kiyosaki warns of a potential bubble forming in financial assets, including Bitcoin, silver, and gold, due to speculation and investor optimism. He believes a correction may be imminent, but sees it as an opportunity to buy these assets at lower prices. Kiyosaki had previously stopped buying Bitcoin after it surpassed $120,000, waiting for a clearer financial picture before making further purchases. He advises those who haven't acquired Bitcoin to start small, and is prepared to buy more if prices crash. Currently, Bitcoin is trading at $117,899.

July 22, 2025 • By Precedence Research

The global medical waste management market is expected to grow from $36.84 billion in 2024 to $79.83 billion by 2034. The market is driven by the increasing amount of healthcare waste, stricter regulations, and a focus on sustainable practices. North America dominated the market in 2024, while the Asia Pacific region is expected to grow at the fastest rate during the forecast period. The off-site segment held the largest share of the market in 2024, while the incineration segment dominated the treatment method market. Key players in the market are investing in advanced technologies and sustainable practices to manage medical waste effectively.

July 22, 2025

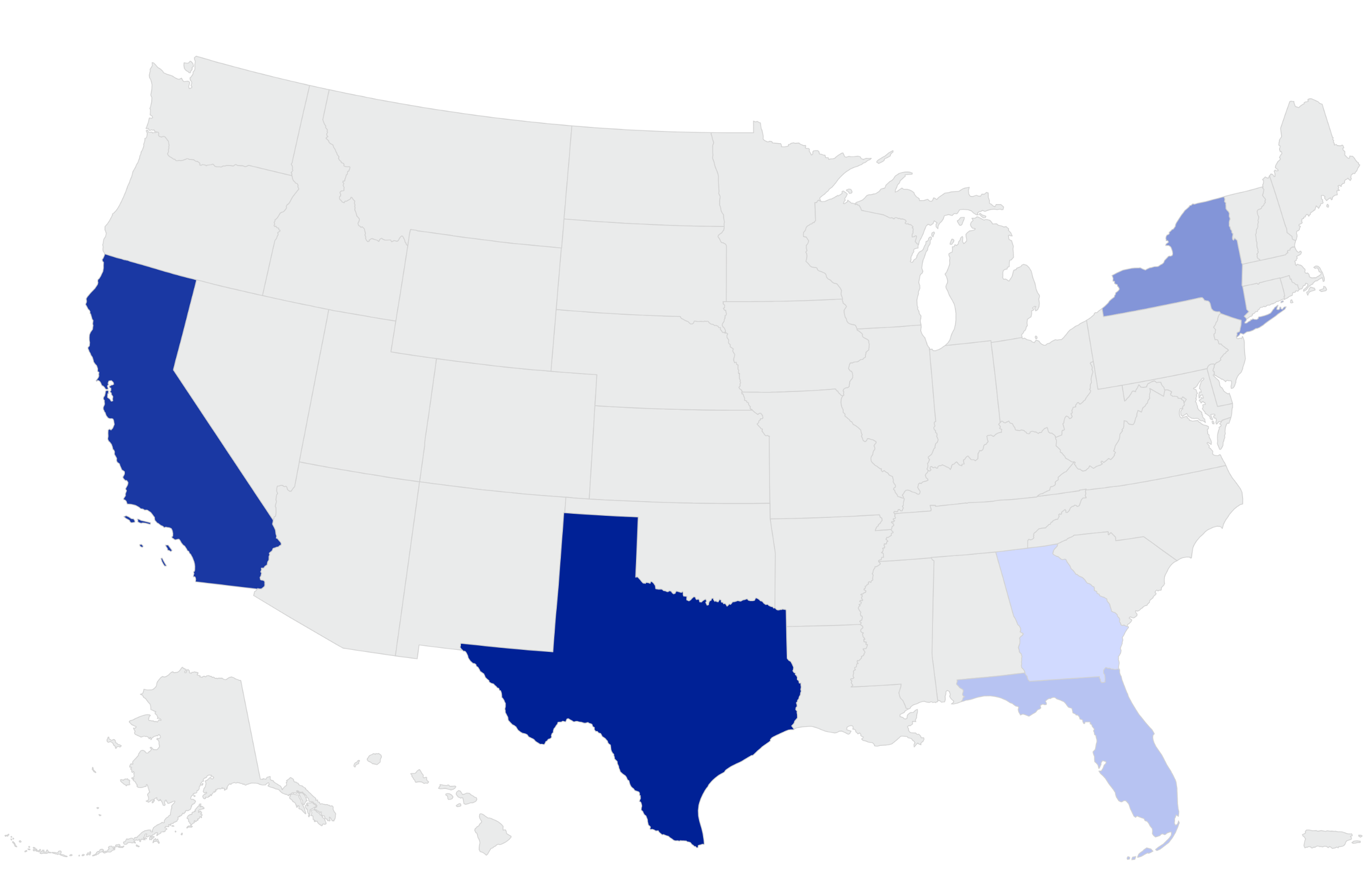

Here is a concise summary of the news article: The Tax Management Market is expected to grow rapidly, reaching $33.21 billion by 2030 at a CAGR of 6.3%. The market is driven by the adoption of advanced technologies such as AI-driven compliance platforms and cloud-native infrastructures. The on-premises deployment mode is expected to hold the largest market share, while tax configuration and advisory services are poised for the fastest growth. North America is expected to hold the largest market share due to its complex regulatory structures and high digital maturity. Key players in the market include Avalara, ADP, Intuit, and Thomson Reuters. The market is expected to be driven by the increasing demand for precision in configuring tax engines and the need for scalable, auditable, and frequently updated tax platforms.

July 22, 2025 • By Pamela N. Danziger, Senior Contributor, Pamela N. Danziger, Senior Contributor https://www.forbes.com/sites/pamdanziger/

Here is a concise summary of the article: Amazon Prime Day saw mixed results, with initial sales reports being disputed and final growth estimated at 4.9%. Despite this, consumers showed strong purchase intent, actively seeking deals across retailers due to inflation. Analysts project 2.5-3% Q4 retail growth, highlighting consumer resilience despite economic uncertainties and potential supply chain challenges. A post-Prime Day survey found that 48% of consumers made a purchase, with 43% spending more than last year. Consumers also engaged with competing sales events and sought to maximize value across multiple retailers. Looking ahead to the holiday shopping season, Coresight forecasts a 2.5-3% retail growth, with a 45% probability, and a 30% probability for a 3.5% year-over-year increase. However, there is also a 25% probability of retail sales declining by 2.5% or more in the fourth quarter due to economic uncertainty and supply chain issues.

July 22, 2025 • By Hugh Cameron

Here is a concise summary of the news article: The US logistics industry is facing significant pressure due to a surge in freight demand and a critical shortage of truck drivers. A survey by Tech.co found that 63% of US logistics businesses reported an increase in freight demand over the past year, but 69% struggled to meet this demand due to driver shortages. The shortage, which is expected to reach 160,000 by 2030, is exacerbated by fluctuating tariff policies and may lead to product shortages and increased costs for consumers. Companies are prioritizing retention and employee satisfaction to address the issue, but the long-term outlook for the industry remains uncertain.

July 22, 2025 • By Nick Lichtenberg

Top economist Mohamed El-Erian has called for Federal Reserve Chair Jerome Powell to resign, citing the need to protect the institution's independence from political attacks. El-Erian, a former CEO of PIMCO, believes that Powell's continued presence will lead to further criticism and erosion of trust in the Fed, potentially causing economic instability. He points to several scandals and missteps under Powell's leadership, including the handling of inflation, an insider trading scandal, and the collapse of Silicon Valley Bank. El-Erian argues that Powell's resignation would help defend the Fed's credibility and autonomy, and prevent further reputational harm. His comments are notable for their candor and counterintuitive reasoning, as most financial leaders have urged Powell to resist pressure from the White House.

July 22, 2025 • By Nick Lichtenberg

Top economist Mohamed El-Erian is calling for Federal Reserve Chair Jerome Powell to resign, citing the need to protect the institution's independence from political attacks. El-Erian's comments are notable for their candor and counterintuitive reasoning, as most financial leaders believe Powell should stay to maintain central bank independence. El-Erian has been critical of Powell's handling of inflation and the central bank's response to controversies, including stock trading during the pandemic and the collapse of Silicon Valley Bank. Despite no evidence of wrongdoing, Powell has faced criticism and scrutiny from the Trump administration, including over office renovation expenses. El-Erian believes Powell's resignation would help safeguard the Fed's independence and reputation.

July 22, 2025 • By Jacob Parry

The European Commission has launched a full-scale antitrust probe into Universal Music Group's (UMG) proposed $775 million acquisition of Downtown Music. The deal involves UMG's Virgin Music Group acquiring key assets, including distributor FUGA and digital distribution service CD Baby. The Commission has concerns that the acquisition will restrict competition in the music industry, particularly for independent record labels. The investigation will last 90 days and is expected to conclude by November 26. Independent record label executives, such as Martin Mills, have expressed concerns that the merger could harm the production of alternative music. The probe was triggered by complaints from indie labels in the Netherlands and Austria, and the Commission will examine whether the acquisition will give UMG control over key production inputs.